The Dire Downfall of Pakistan’s Economy

BY URMILA UDHALIKAR / OCTOBER 1, 2022

Pakistan is a country with a population of 230 million. Even while possessing nuclear power, and a position of geostrategic importance, it is turning into an unstable political and economic system.

he decline of the Pakistani economy has been ongoing for 70 years. In 1947, Pakistan was primarily an agricultural country with severe poverty . Following independence, the country took several steps to restructure its agricultural industry, aiming to increase output and exports. The government began to focus on industrialization in the 1950s, adopting the five-year planning model. Pakistan's average annual GDP growth rate in the 1960s was 6.8%. However, this wasn’t as long-lasting as it was expected to be.

T

The political disturbance that started in the late 1960s ended with the crisis of 1971. The consequent separation of the former East Pakistan changed the country. The new government negligently received the deteriorating economic growth, and the country was faced with post-war rehabilitation challenges. Pakistan suffered from a devastated economy, high inflation rate, and stagnant agricultural and industrial sector. In addition, the economic strategy had shifted toward nationalisation which negatively impacted private investment in the economy. In the 1980s due to slower economic growth, the nationalisation policy was reversed but the country could not remodel at par with the structural changes and it only saw slight economic growth.

.jpg)

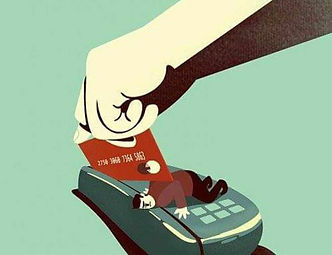

Illustration by Unknown via Pinterest

Every new leader is aware that they may be notified to leave the position at any given moment, hence their sole focus shifts towards power struggles rather than actual development.

Political instability is the most evident and apparent cause of Pakistan's failure of its economy. Due to Pakistan’s volatile politics, it faced several issues. Firstly, despite having valuable assets such as abundant labour and a skilled workforce, international businesses are still unsure of their position in the Pakistani market because of the varying taxation regimes imposed by subsequent governments. Every new leader is aware that they may be notified to leave the position at any given moment, hence their sole focus shifts towards power struggles rather than actual development. Further, Pakistan's war-brokering business-terrorist groups add to the list of problems. These groups operate as labour outsourcing companies or international politics freelancers with governments and other parties. After the United States invaded Afghanistan in 1979, the Soviet-Afghan war raged from 1979 until 1989. Since the United States planned to join the battle, the American government outsourced the military project, which provided human resources to execute it at an extremely low cost.

Pakistan's membership in the IMA is an antithesis to reifying the concept of bringing economic prosperity to the country.

Pakistan believes that by joining the 41-nation Islamic Military Alliance (IMA) formed in the Middle East (ME), it will increase its international presence and gain a larger role in the ME as well as the world. But, Pakistan's membership in the IMA is an antithesis to reifying the concept of bringing economic prosperity to the country.

To reduce domestic financial imbalances and external deficits, Pakistan implemented economic stabilisation and structural reform policies in 1988.land consistent. Policy measures did not achieve their objectives because of uncertain political conditions, rising income inequality and institutional corruption, causing the Pakistani economy to remain trapped in a vicious circle of poverty, low growth, low savings, and low investment, impeding growth and poverty alleviation even further.

Pakistan has therefore become confined in a 'debt trap' as its external debt continues to grow.

.jpg)

Illustration by JBenedetto Cristofani via Pinterest

As of March 2022, the country's total external debt and liabilities were about USD 128 billion. Pakistan has received massive financial help from countries such as Saudi Arabia, the United Arab Emirates, and China over the years. Additionally, it also acquired loans from international institutions such as the IMF, the Asian Development Bank, and the World Bank. In the last 30 years, the IMF has bailed out the country 13 times. Pakistan has therefore become confined in a 'debt trap' as its external debt continues to grow. The pandemic and low tax collection have exacerbated the situation.

According to data released by the State Bank of Pakistan, the current government paid USD 11.9 billion in external public debt servicing between 2019 and 2020. Due to Pakistan's failure to pay its debt, this significant amount of money failed to be used for other purposes like education, healthcare, and so on.

According to The Express Tribune, Pakistan is on the brink of death of an economic disaster with only USD 8 billion in foreign exchange reserves. With a trade deficit of USD 50 billion and an inflation rate of 18%, the Pakistani rupee fell sharply against the dollar due to price increases in fuel, gas, electricity, food, and medicines. It fell 16.5% against the US dollar in June 2022, making it Asia's worst performing currency in 2022. Pakistan is unable to increase its exports, which remain stagnant at between USD 24 billion per year. This reduces the country's foreign reserves because imports are higher than exports.

Civil-military relations are undoubtedly an internal matter in Pakistan. However, they have the potential to influence the contours of its foreign policy. With 23 IMF programmes and a perennial balance of payments problem for the majority of its history, Pakistan has always been weak on policy. Its policy making and implementation rankings have been low in many sectors, which should be of concern to the country's economy.

.jpg)

Illustration by Yasmine Gateau on Behance.

There is a strong perception that the desired results for the people have not been achieved. Rather, the results were materialised due to a lack of consistency and prescribed time limits in the implementation of public policies. Potential financial and human resources of the country are being drained with almost no productive output or impact, and the costs and public funds of these policies have also increased and burdened the national exchequer. There is an urgent need to review the policymaking process and identify areas of preparation, efficiency, and effectiveness of governance at all levels, i.e. federal, provincial, and local government levels, with a serious concern for development and growth in the short and long term strategies, as well as an implementation strategy.

The role of money in politics in Pakistan has given rise to a new class of wealthy businessmen turned politicians who have consistently prioritised their commercial interests over national economic advantage, leading to growing inequalities.

Furthermore, corruption continues to be a significant barrier in Pakistan, where it is still perceived to be widespread and systematic. The role of money in politics in Pakistan has given rise to a new class of wealthy businessmen turned politicians who have consistently prioritised their commercial interests over national economic advantage, leading to growing inequalities. In the 1980s, Pakistan received the majority of its aid in the form of grants, which were used to line many pockets. Rent-seeking in land acquisition and reckless economic projects such as the ‘Green Tractor Scheme,’ ‘Yellow Cab Scheme,’ ‘Karachi Mass Transit Project,’ have been major sources of corruption. Exorbitant valuations of the same have resulted in massive increases in project costs.

.jpg)

Additionally, in Pakistan, double-digit inflation is said to have persisted for several years. Various governments have implemented policies to control inflation, but all have failed. Pakistan imports a large amount of goods from other countries, and as a Small Open Economy (SOE), the domestic economy cannot escape the aftereffects of international price increases. The problem has gotten worse as

Illustration by Augusto Zambonato via Pinterest

Pakistan's national currency has been devalued, forcing the country to accept international price increases for raw material imports. This external price shock will result in high domestic commodity prices and, as a result, inflation. Pakistan has also been afflicted by massive unemployment and brain drain whereas foreign remittances continue to be a major contributor to inflation in Pakistan. Black money obtained through smuggling, tax evasion, and other such means increases demand for luxurious goods, which further adds to the inflation.

More domestic production should be encouraged by the government, and imports should be allocated to necessities rather than luxury items.

What seems to be a good solution is devising a macroeconomic policy to avoid high inflation. It can be controlled through monetary policies, fiscal actions, political stability of the government, encouraging people to save, and other policy decisions which will lead to lower down the inflation. More domestic production should be encouraged by the government, and imports should be allocated to necessities rather than luxury items. To keep inflation under control, the government should cut down unnecessary spending. As a result, the gap between expenditure and income will narrow, and the current account deficit will not be issued.

Besides that, a more aggressive debt restructuring programme is required in Pakistan. At the moment, the country spends one-third of its federal budget on debt interest, which is not a good sign for a developing country. The country's military spending can be reduced because it consumes a large portion of its budget and yields poor results. To avoid excessive spending cuts, greater emphasis should be placed on increasing revenue from consumption, income, and wealth taxes to achieve fiscal balance. To maintain positive wage growth among low and middle-income employees, particularly clerical workers, and to avoid the intensity and severity of poverty among urban households, the public sector's salary structure must be reviewed.

Keywords

Pakistan, Pakistan Economy, Debt Trap, Islamic Military Alliance, political instability, Pakistani Government, economic crisis, economic instability, “Green tractor scheme”, “Yellow Cab scheme”, “Karachi Mass Transit scheme”

References

Sources:

-

(2022, July 28). Pakistan on brink of economic collapse. The Economic Times. https://economictimes.indiatimes.com/news/international/world-news/pakistan-on-brink-of-economic-collapse/articleshow/93191862.cms

-

Khan, S. U., & Saqib, O. F. (2008). An analysis of Pakistan's vulnerability to economic crisis. The Pakistan development review, 46(4), 597-610. Jstor.org https://www.jstor.org/stable/41261184

-

Liberalization and Economic Crisis in Pakistan. Asia Regional Integration Center. https://aric.adb.org/pdf/aem/external/financial_market/Pakistan/pak_mac.pdf

-

Why has Pakistan not realized its economic and political potential? (2022, August 13). Telegraph India. https://www.telegraphindia.com/world/why-has-pakistan-not-realized-its-economic-and-political-potential/cid/1879980

-

How PAKISTAN committed SUICIDE with its ECONOMY ? : Pakistani Economic Crisis case study. (2022, April 19). YouTube. https://youtu.be/SGpTBKbGcQ8

-

Rehan, M. F. (2011, November). Inflation in Pakistan: Antecedents and consequences. Researchgate. https://www.researchgate.net/publication/286607358_Inflation_in_Pakistan_Antecedents_and_consequences

-

Anonymous. (2022, July 31).Pakistan failed to settle down as a nation-state. The Print. https://theprint.in/world/pakistan-failed-to-settle-down-as-a-nation-state/1063139/

DISCOVER MORE STORIES

SEPTEMBER 24

BY SRUSHTI PUNGHERA

The views published in this journal are those of the individual author/s and do not necessarily reflect the position or policy of the team behind Beyond Margins, or the Department of Economics of Sophia College for Women (Autonomous), or Sophia College for Women (Autonomous) in general. The list of sources may not be exhaustive. If you’d like to have the complete list, email us at beyondmarginssophia@gmail.com